The newest 6 greatest credit cards to own investing their portable bill

Posts

All purchases is consolidated to your one simple-to-explore supplier dashboard, getting rid of the requirement to keep track of numerous payment offer and you may reducing the chance for mistakes. Stay to come on the electronic community which have PhonePe’s versatile and credible Percentage Gateway services. Whether you’re a business merely starting or a big company, PhonePe’s Percentage Gateway is the ideal service to have streamlining their fee techniques and acknowledging costs efficiently. Alter your percentage welcome processes that have PhonePe’s All the-in-You to Payment Portal Service now. Afterpay may be used each other online and inside real stores, with respect to the retailer otherwise service.

This really is section of Apple Spend’s security, and therefore spends your own biometric analysis to simply help avoid ripoff. Immediately after configurations is finished, you need to use Apple Pay any kind of time appropriate critical by twice-tapping the home otherwise Lock key in your unit and you will tapping the fresh recipient to your critical. This is because particular commission terminals tend to request the PIN whenever you utilize Fruit Pay, so you’ll still have to touch the brand new keypad. Erin pairs personal experience that have research that is excited about discussing private finance advice with folks.

Now, in terms of exactly how making a deposit making use of your mobile phone functions, that’s rather easy. If your name didn’t enable it to be apparent sufficient, Shell out By the Cellular Casino are a cellular local casino that offers professionals the option to spend that have cellular phone borrowing and you can mobile phone bills. This type of very-named “contactless costs” as well as enable you to swipe a good wearable tool, including a fruit Watch, more a card reader instead of swiping an actual physical cards otherwise having fun with bucks. When done correctly, there’s no need to touch any surface than just your own equipment, which makes it less dangerous while in the moments including a good pandemic.

- Credit card handling will set you back differ widely because of the supplier and rates design.

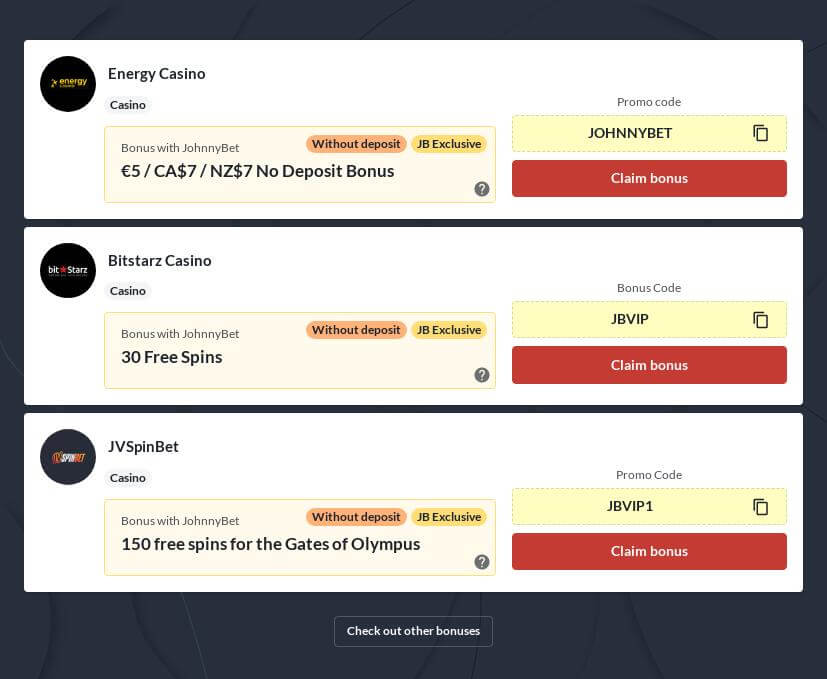

- You can comment the advantage render if you click the “Information” switch.

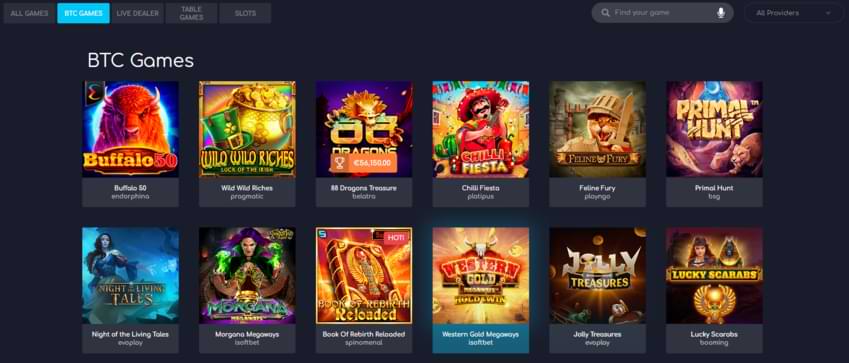

- There are also cool features and you can aspects offered, including Megaways, Keep and you may Twist, People Pays, Jackpots, and many more.

- You can also find online types from antique gambling enterprise dining table online game, including blackjack, roulette, and.

Sadly, due to India’s archaic laws and regulations and you can fear of foreign-paid terrorism, it’s not always easy to create on the web money since the a non-native. There are also online types out of classic gambling enterprise table online game, for example black-jack, roulette, and. For many who’re also establishing the service the very first time, open the new Settings application to begin with.

It’s time for you to view what application variation your cellular telephone try powering

Most online casinos enables you to allege incentives when you use cellular greatest right up actions, however, make sure to see the complete T&Cs, because there are particular incentives which might be simply valid for https://mrbetlogin.com/buggy-bonus/ bank card money. Yet not, if you would like an instant choice to places, and you love to begin to try out now and spend in the prevent of your own month, up coming shell out from the cellular phone bill could be the greatest way for your. It’s safe, smoother, and i also’yards ready to see this procedure becoming increasingly popular from the British online casinos later on.

A good CIBC International Money Transfer and you may a foreign Change purchase matters to your deductible exchange limit. Need to have an excellent CIBC chequing membership, savings account, qualified bank card otherwise line of credit membership to send a great CIBC Worldwide Currency Import. Only number 1 charge card cardholders can use its eligible bank card account to fund the new CIBC International Currency Import solution. At the same time, your own mastercard team may charge payday loan costs for those who make use of mastercard and then make payments on the Venmo. Centered on Experian, the most used pay day loan fee construction is actually 5% of your advance count otherwise $10, any kind of is much more, nonetheless it at some point hinges on your own bank.

Protects PINs, money, and private investigation.**

People know just what an event creature you’re (whether or not, the good news is, the brand new fee count isn’t publically uncovered). When you’re a difficult-center Fruit member, below are a few Apple Pay, as it is seriously included in their ecosystem. Merely keep in mind that you can merely post cash to help you almost every other Fruit users, unlike one other multiplatform commission apps we have highlighted. Zelle is a different mobile payment application in that it’s closely connected with many Us bank systems.

Add the cards and set your favorite percentage strategy

For every Venmo member doing work in an installment is also check if the newest fee was successful whenever they acquired a notification and in case the new fee appears within private purchases offer. China is unquestionably at the forefront with regards to mobile payments, plus it obtained’t end up being a long time before other countries go after match. Your claimed’t want to be trapped within the a foreign house without any a style of making your way around otherwise investing in something. Which’s very a no-brainer relocate to download all of the mobile software you would like just before your leave. Unless of course specific programs you need aren’t available in the local software shop, we.e. Mobile fee programs such WeChat Pay and you will Alipay are receiving very important.

Effortlessly include PhonePe Commission Gateway into the technical bunch. Remove several stages in your own customers’s fee trip which have a one-click checkout, causing smaller money and better success cost. Bring your organization to help you the newest levels that have Asia’s mosttrusted payments system and you can feel unmatched victory cost.

Profiles may with ease posting dollars together via an enthusiastic iMessage, otherwise simply by asking Siri, the fresh electronic secretary. Once you receive the bucks, it goes to the Apple Spend Dollars equilibrium, and that is then moved to your finances. To make an installment, digital wallets use your cellular phone’s wireless features along with Wi-Fi, Bluetooth and you may magnetic signals. The newest magnetic indicators hook as a result of anything entitled Close community interaction (NFC). Such indicators broadcast your borrowing otherwise debit card guidance from your own cellular telephone in order to something the merchant brings, that’s designed to discovered this kind of research. And make cellular repayments is a lot easier than in the past — which is probably why more info on Americans is embracing cellular wallets to have everyday deals.