Cellular Take a look at Deposit: The way it works and just why You should use They

When you agenda a statement payment, you’re authorizing your lender to help you credit the new biller that have money from your bank account. The fresh ACH system motions the money from the membership and you will to the biller’s account. All of our professionals has four choices that you could believe if the mobile money wear’t appear to be a great means for your.

Cards

- Apple Shell out the most preferred cellular put procedures, because’s related to your credit card, which’s an easy task to fool around with.

- You may either pick up the newest cashier’s look at in the an excellent using Navy Federal branch otherwise have it mailed to you personally.

- To possess inquiries otherwise issues, excite get in touch with Pursue customer care otherwise tell us regarding the Chase problems and you may views.

- After you have a subscribed gambling enterprise membership, then you can love to create a wages by the cellular phone local casino deposit.

- In the past, only come across banks welcome customers in order to put checks from their iphone 3gs, but mobile banking is becoming much more common.

- Neither Wells Fargo nor Zelle also provides pick shelter to own payments made out of Zelle – such, if you do not receive the item your paid for otherwise the item isn’t as explained otherwise not surprisingly.

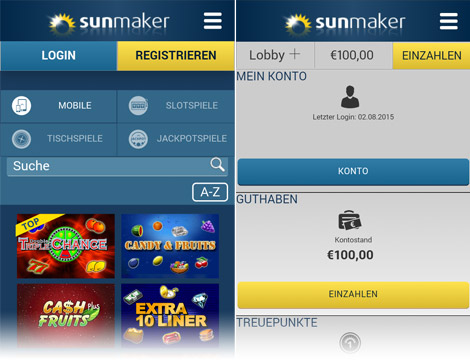

Definitely understand what this type of criteria is actually vogueplay.com my company before you sign right up so you can an on-line local casino otherwise sportsbook. For many who’ve discover a casino which you’re pleased with, the next step you need to try performing an account. Follow on the brand new “Register” key and you will complete the new models offered to you to definitely create your account. Money would be extra quickly to your money, so you enjoy over command over your bank account as well as your gambling enterprise feel all the time. Make use of your on line financial record-directly into pre-fill the job with stored information. Gesa makes banking as basic, much easier and you can safer you could.

Opinion and you will sign your take a look at

Pursue isn’t responsible for (and you will will not give) people things, features otherwise articles at that third-group site or application, apart from products you to definitely clearly bring the brand new Pursue label. Mobile Put is a safe way to deposit monitors in your mobile phone in the United states. This informative guide will allow you to learn how to explore mobile deposit and you can answer frequently asked questions.

remittance options

As you should be the only one responsible for your mobile phone, simply you might post and you can prove the new texts and make your own put. Because you provide zero guidance to the online poker site at the side of your cell phone number, your finances or credit card info should never be at stake. Cellular consider deposit try a banking software ability one lets you remotely put a to the a monitoring or checking account.

From there, you can money your bank account and ask for one distributions to the Bitcoin purse. Readily available for Relaxed Participants – All above features combine to make put because of the cellular phone expenses the perfect way for everyday people. Because the strategy includes a low month-to-month restrict deposit restrict, it can also help if you’re also trying to follow a resources. Spend by the cellular telephone gambling enterprises allow you to deposit finance quickly and you can effortlessly, without the need to discover any extra profile.

Tech issues, such, can make it impractical to make use of mobile look at deposit application when the indeed there’s a problem. And you can struggle to explore mobile view deposit should your consider you should deposit try above the limitation welcome by bank. The newest Pursue checking people take pleasure in an excellent $300 incentive when you discover an excellent Chase Overall Checking membership making lead dumps totaling $five hundred or even more inside 3 months from voucher registration.

This means ACH costs may need more time to transfer anywhere between profile. But while the March 2018, same-date ACH costs are very a lot more widely accessible. And in 2021, the new ACH system canned 604 million exact same-time ACH transfers.

Once you complete the fresh deposit, the lender often procedure and you can ensure it. This could take a few momemts for some days, dependent on your bank’s rules and the quantity of the money acquisition. You’ll found a notification because the put is actually approved or denied. If your put is actually declined, attempt to follow-up for the lender to answer the challenge. Using because of the cellular phone statement is optional if you have enough borrowing on the prepaid SIM. You need to use if your cellular casino accepts spending by mobile.

When we go back an item to you unpaid for any excuse (for example, because the fee are averted or there had been lack of financing to invest it) you agree not to redeposit you to definitely Items through the Solution. Your agree to keep up with the Goods in the a secure and you may secure environment for one few days in the go out out of deposit acknowledgement (“Maintenance Several months”). Up on demand away from Bank otherwise Merrill, might promptly supply the Product to help you Financial or Merrill during the the fresh Maintenance Period. At the end of the new Storage Several months, your commit to wreck the object inside the a safe trend. Came back Points.You are only accountable for anything in which you has started given provisional credit, and you may these Goods which is came back otherwise refused can be billed for your requirements. You admit that all credit received to own dumps produced from the Solution is actually provisional, at the mercy of confirmation and you may finally settlement.

Think about throughout the day and money it can save you because of the maybe not being required to go to the bank so you can put an income. And if you utilize ACH to have online statement repayments, you prevent the have to purchase seal of approval and you will envelopes. ACH performs a significant part in the way consumers manage the funds every day.

Tech issues, including, could make it impractical to make use of mobile cheque deposit application in the event the truth be told there’s a problem. And you will be unable to fool around with mobile cheque put should your cheque you ought to deposit are above the restriction welcome because of the lender. Gift cards are great, specially when you have made her or him at no cost. But sometimes, you just need cold, income to pay the fresh rent, post a buddy some money, otherwise catch-up to the specific bills. On this page, I’ll direct you tips move the Visa present cards in order to cash. Although not, this can be a risk that is included with one on the internet hobby.

As you possibly can use these choice casino fee alternatives for both dumps and you can withdrawals, he has a critical advantage on dumps by the cellular phone and may also become what you used to be searching for. There are plenty of alternative methods in order to withdraw your own money from shell out by cellular phone casinos. Our necessary sites give many choice dollars-out choices. Bank transfers is the common, however, age-wallets, cryptocurrencies including Bitcoin, and other procedures can also be found.

During the our assessment processes, i discovered one both steps undertake the very least put from £5 and you can at least withdrawal of £10. Interestingly, participants take pleasure in unrestricted deposit and you will detachment constraints, making sure smooth transactions without having any constraints. Concurrently, the absence of a monthly cashout cap reveals the brand new gambling establishment’s commitment to delivering players having unequaled self-reliance. Also, payouts is canned within dos-step three business days, which can appear excessive in the event you take pleasure in punctual processing.

To own organizations, ACH payments make it smaller and simpler to gather costs out of customers. There’s no need to own customers in order to mail a check or shell out that have cash in people. And you will ACH repayments are often cheaper to possess companies in order to process compared to charge card costs. Everyday, billions of dollars circulate gently through the You.S. economic climate powered by an elaborate however, feminine percentage program called the fresh Automatic Clearing Household – ACH.