Choice Having fun with Cellular phone Expenses Spend because of the Mobile Playing Sites British

Articles

With this particular last step, you have got achieved a whole knowledge of tips see pending dumps on the Dollars App and take the necessary actions related to your pending dumps. Once you faucet on the equilibrium, you are led so you can a display giving a in depth writeup on your bank account balance. That it monitor might direct you the full equilibrium, readily available harmony, and you will any financing which might be currently pending or lower than comment.

Orientxpress casino | Choosing a knowledgeable Online Banks One to Bring Dollars Places to you

Then view the needed internet sites less than, handpicked because of the we from pros. Even although you discover you need an on-line lender that takes cash places, you’ll have to restrict the choice. Distinguishing an educated on the web lender to you personally boils down to the newest pursuing the issues. For individuals who’re also already an environmentally-friendly buyer, Atmos’ Cash-Back Checking account can provide as much as 5% cash return in your orders. Many purchases are electronic these days, cash hasn’t remaining our lives totally. The newest digital world is also log off all of us questioning what to do whenever people hand all of us an excellent five-dollars expenses instead of a cards.

Manage a lot more to the Pursue Mobile app

Your website you are planning to enter into may be quicker safer that will features a confidentiality declaration one to is different from Frost. The items and you can features considering with this third-team website commonly provided otherwise guaranteed by the Freeze. You can utilize our mobile app otherwise our website to plan a consultation to fulfill around inside a financial center or get a trip right back by the cell phone.

Put inspections out of your cellular telephone – save a visit to a Orientxpress casino part or Atm. Learn in the getting the Virtual assistant benefit money because of lead deposit. For individuals who wear’t have a bank account, the brand new Experts Benefits Financial Program (VBBP) can be link your with a lender that may help to prepare an account. For individuals who currently have one, find away how to improve your direct put information.

- When you can be withdraw of a demand put account either quickly otherwise in a few days, identity deposit account are designed to keep your bank account to own an excellent particular time frame.

- You’ll start the fresh fee techniques on the web on the ConnectNetwork account, then complete the transaction having bucks from the an excellent playing local shop.

- Our Believe Fund provider enables you to deposit currency directly into an inmate’s commissary membership.

- You can expect Totally free user friendly Custodial deposit defense, and you will a competitively-listed Covered scheme.

- Just begin their deal because you normally perform, come across View more regarding the head eating plan after which Changes PIN.

- You to short breeze of one’s look at isn’t all that’s needed to ensure a successful transaction.

- The newest software uses SSL security technology to protect yours advice and you may financial deals.

Mobile Dumps is actually report inspections transferred because of the the recipient using a great digital camera or scanner without the need to go to an actual borrowing from the bank connection otherwise lender department place. It’s a component of many cellular financial programs which allows you to definitely bring a graphic of the take a look at and upload which have just a few ticks, no matter where you’re. The HFS profile, except Company Accounts, meet the requirements to use Mobile Put should they are enrolled in On the web Banking and possess installed the fresh Cellular App. Discover Pursue.com/QuickDeposit or even the Pursue Cellular application to own eligible cellphones, constraints, terms, criteria and information. Yes, cellular take a look at deposit is actually included in numerous levels from security.

In order to be eligible for the fresh high APY, you really must have an automatic deposit with a minimum of $five hundred and you will seven electronic distributions (such as requests, Atm distributions, costs repayments, an such like.) 30 days. Should your account doesn’t meet these types of criteria, the brand new APY is 0.10% for the few days. That it membership includes a competitive 5.25% APY to the all balance sections no minimal balance or monthly restoration fee.

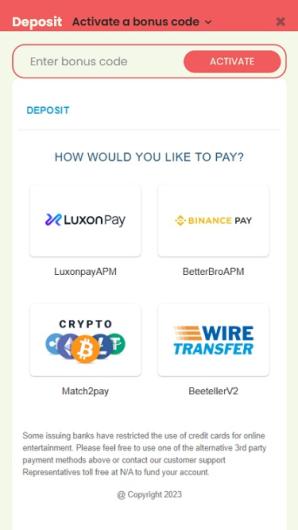

Deposit incentives are a pleasant extra that you may possibly score after getting down money, if you are no-deposit bonuses is given for joining. Naturally, you will probably need to find those individuals casinos you to particularly take on their picked cellular phone percentage method. This can be done from the ticking the relevant container from the ‘Payment method’ area.

Atm deposit comes to deposit a myself in the among your own bank’s ATMs. Your own bank can get inform you whenever a is recognized, either making use of their cellular application otherwise an email. When this happens, think writing “void” otherwise “placed because of the cellular” over the side of the take a look at and keeping it until the fresh deposit shows up on the account. Just after verifying which you can use the brand new cellular deposit provider and you will that your particular consider drops inside the cellular deposit restrictions, recommend the new take a look at from the finalizing on the back.

Show together with your sportsbook when you’re allowed to explore a great pay by the cellular deposit to allege a deal. Particular put possibilities have certain laws and regulations nearby her or him which do not ensure it is bonuses as advertised. Look at the deposit part of the playing program, discover the means, and kind on the sum of money you should deposit.

- Phony look at frauds generally encompass a good scammer getting in touch with their prey thanks to email or social networking post because the a potential workplace, lender, or curious buyer on the a marketplace webpages.

- Keep this type of points in mind and you may, in time, they’re going to end up being next nature.

- Players may also get some good casinos on the internet hold certificates off their reliable authorities including the Malta Betting Expert.

- You need an excellent postpaid partnership, in which the cellular phone seller usually bill you monthly.

- You could deposit dollars at any of their connected AllPoint+ ATMs.

- Extremely banking institutions haven’t any sort of deposit limits to the the ATMs.

Observe how we have been intent on enabling protect your, your accounts as well as your family from economic punishment. In addition to, find out about the common techniques fraudsters are utilising in order to stand a stride before her or him. When you see not authorized costs or believe your bank account is actually jeopardized e mail us instantly so you can statement fraud. Just like a traditional put, there’s usually the possibility one to a check could possibly get jump. To be sure the financing is transferred precisely, it’s smart to keep hold of your own inspections before the deposit has cleaned. Like that, there is the check into turn in circumstances anything fails at that time.

Mobile cheque put is actually a cellular financial device that allows you to put cheques for the family savings making use of your mobile device. Extremely hyperlinks within articles give payment so you can Slickdeals. This is exactly why we offer of use products to evaluate these offers to fulfill your objectives. Be sure to make sure all terms and conditions of every borrowing from the bank card before applying.

Mobile take a look at put is a banking software function you to definitely enables you to from another location deposit a check on the a monitoring or savings account. The bank’s cellular consider deposit contract usually outline the sorts of checks you happen to be allowed to put. Cellular deposit is an easy, smoother, and you will safer way to put checks into the savings account rather than needing to go to a financial department in person.

UFB Lead costs couple typical charge, but the bank tend to charge for overdrafts and you may distributions in excess out of half a dozen monthly. Although not, you might stop overdraft charge from the linking an excellent UFB Lead checking account for the checking account because the overdraft transfers between connected account don’t bring a fee. Online financial institutions are among the better innovations of one’s past three decades, giving safe access to your own membership 24/7 and far large rates than history banking institutions. The main one problem one online financial institutions have trouble with are dealing with cash places.

Whenever distribution a check to possess mobile put, you’ll have to recommend it by the finalizing your identity. Under your trademark, you’ll also need to produce some type of your own terminology “for mobile put only,” depending on what your financial otherwise borrowing from the bank partnership needs. Financial legislation want this article and you can, without it, your mobile view deposit may be refused.

Pursue Overall Checking is amongst the better admission-height membership. It generally also provides new customers an indicator-upwards added bonus, and it’s fairly simple to waive the new $12 monthly fee. But not, it’s worth noting so it doesn’t provide of numerous rewarding features or professionals and it also’s perhaps not a destination-influence family savings. SuperMoney.com is actually another, advertising-supported provider.

Direct Deposit may take 1 to 2 commission cycles when planning on taking effect. You could found a minumum of one paper checks by the post just before direct put initiate. Install and you may done an application to own direct deposit to your examining or bank account by send. Basically, we become handling the modern business day’s transactions, and you can upgrading account stability, by the 8 an excellent.yards. Such, if you are pursuing the up on a that will has cleaned on the Monday, everything might be offered just after 8 a good.meters.

To learn the way to earn Citi ThankYou advantages for your banking relationshipFootnote 1. To understand how you can earn rewards to suit your financial relationshipFootnote step 1. For the back and front of one’s view, an example image will appear on the viewfinder to line up your take a look at so it can be easily read because of the app. Pinnacle Financial try regulated because of the Tennessee Department away from Financial institutions (TDFI) plus the Government Deposit Insurance coverage Company (FDIC). Know about what Pinnacle Lender do with your suggestions. At any section, you might decide-from the product sales of your personal information because of the looking Create Maybe not Sell My personal Advice.

By providing your cellular matter you are consenting for a text. “Which means even basic-go out profiles was effective.” Therefore it is worth upgrading their banking application to the newest type the device aids. Deposit a directly into the eligible examining otherwise checking account with only a number of taps. You need to sign the name on the rear out of a—a method called promoting the fresh view—just before having fun with cellular put. Beneath your trademark, it’s also advisable to produce something like “To have cellular put simply.” Depending on their lender’s assistance, you are taught to include the institution’s name. Our very own lovers do not shell out us to make certain beneficial recommendations of their goods and services.

Help save a visit to the bank because of the transferring inspections with your cellular phone, despite occasions, by simply delivering a graphic. It’s simple, safe and the most simpler way to put inspections. Usually, placing inspections via your bank’s mobile application is a convenient element well worth using. But consider this type of benefits and drawbacks before by using the solution.